ebike tax credit california

Examining e-Bike Rebates in California Benefits of e-bicycling have motivated many cities and countries in Europe to incentivize e-bicycling through a wide variety of intervention programs. The proposal would allow riders to claim one e-bike.

E Bike Purchase Incentives Calbike

1019 by California Representative Jimmy Panetta and is once again gaining momentum thanks to 21 co-sponsors and a companion bill by the same name introduced in.

. Of course a more realistic and common ebike price of 3000 could mean a tax credit of 900and a 2000 ebike might get you a 600 30 credit. If the E-BIKE Act is eventually signed into law it would offer a 30 tax credit of up to 1500 for buying an electric bicycle. The credits also phase out according to.

The tax credit for your e-bike purchase is a percentage of the purchase price of the electric bike. This is an electric bicycle. The E-Bike Act would create a federal tax credit equal to 30 of the purchase price of electric bikes up to a maximum credit of 1500.

If passed e-bike buyers could claim a credit of up to 1500 for any e-bike purchased for service in the United States. This is not the motorcycle youre looking for. The credit begins to phase out for a manufacturer when that manufacturer sells.

The tax credit is capped at a maximum of 900 and would only apply to electric bicycles priced under 4000 which includes a wide selection of quality e-bikes but rules out. The e bike tax credit is a tax credit given to people who purchase an e bike. A In general Subpart C of part IV of subchapter A of chapter 1 of the Internal Revenue Code of 1986 is amended by adding at the.

As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more than 4000. Grew up in Los Angeles. This credit would be available to all e-bike.

The E-BIKE Act is short and simple. It would provide a federal tax credit of 30 percent of the purchase value of an e-bike available once every three years capped at 1500. To qualify the electric bicycle would have to be priced.

The credit is worth 2500 per e bike. The E-BIKE Act is working its way through Congress but if passed consumers could get a tax credit worth up to 1500 on a new e-bike costing less than 8000. The credit ranges between 2500 and 7500 depending on the capacity of the battery.

The credit can be used to purchase an e bike or to pay for the. Credit for certain new electric bicycles.

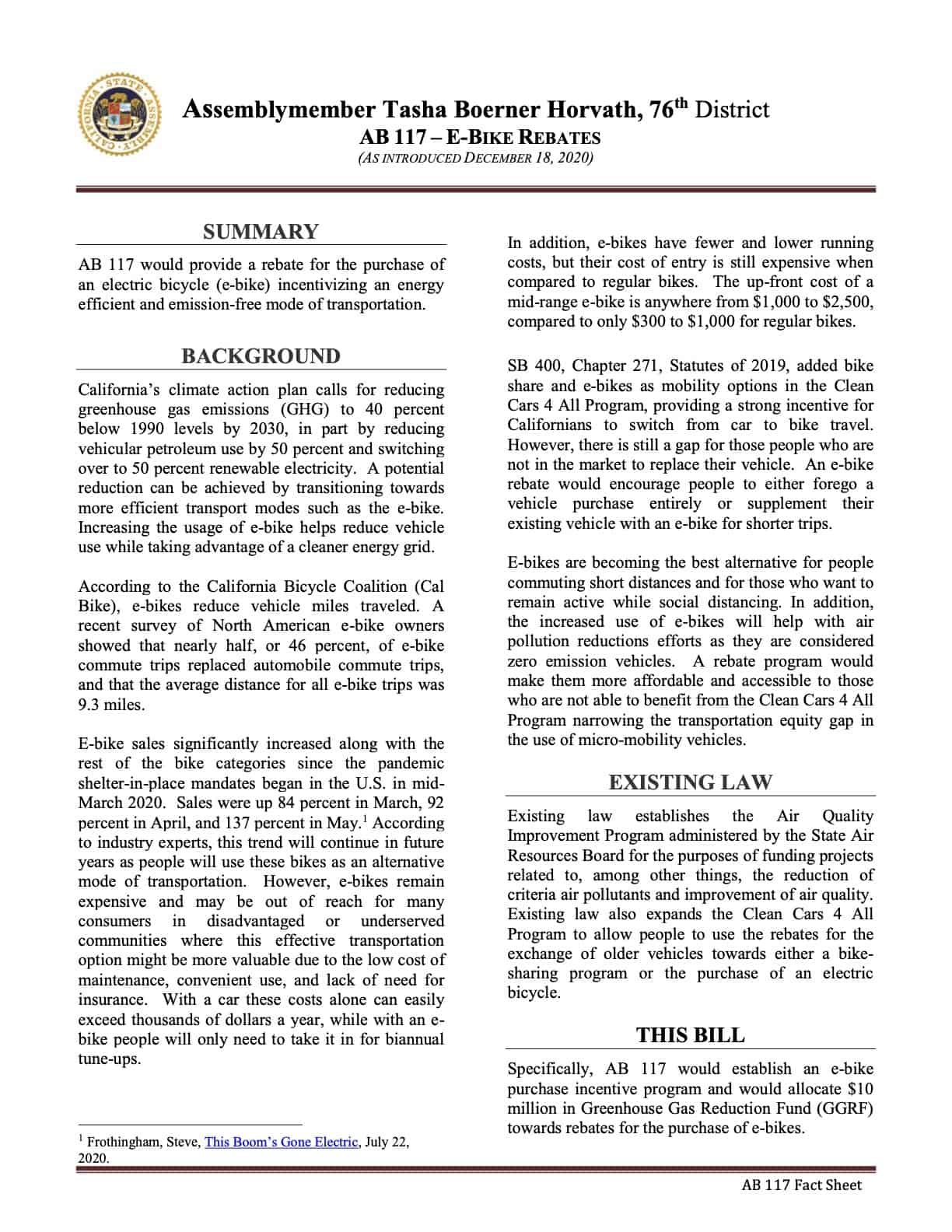

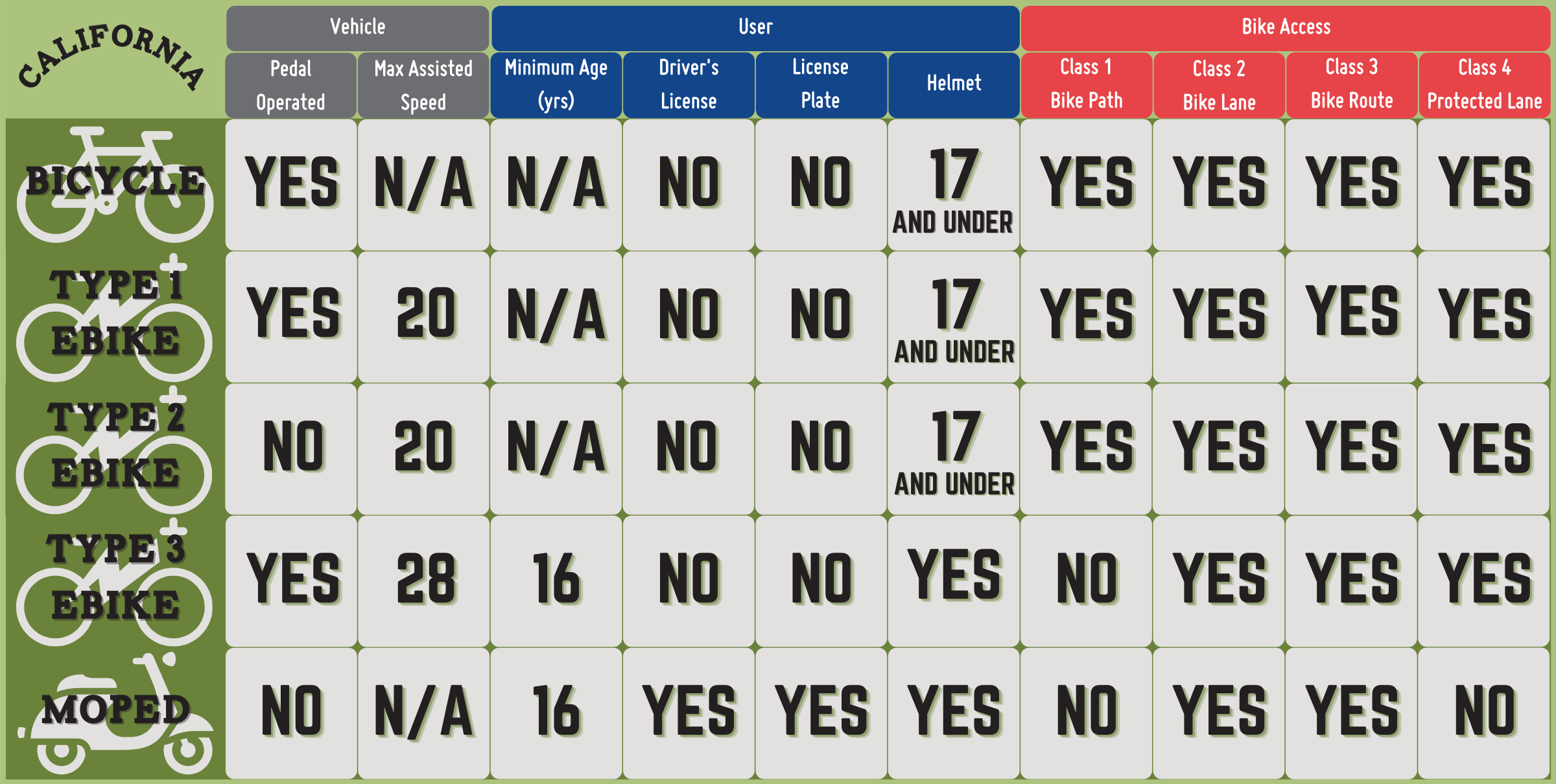

Ebike Classifications And Laws San Diego County Bicycle Coalition

Solicitation For The Electric Bicycle Incentives Project California Grants Portal

Ebike Classifications And Laws San Diego County Bicycle Coalition

E Bike Purchase Incentives Calbike

E Bike Purchase Incentives Calbike

California To Launch Ambitious E Bike Purchase Incentive Program In 2022 Civicwell

Guide To State Local E Bike Rebates And Tax Credits Juiced Bikes

California Plug In Car Sales Up 79 In 2021 Tesla Model Y 2 Overall

Where Are California S E Bike Incentives Streetsblog California

Tesla Model Y A Couple Of Prototypes Make It To Boulder Colorado Https T Co Ige8dx6rpi By Fredericlambert Https T Co Uo2ddzif Tesla Model Tesla Bouldering

Ebike Classifications And Laws San Diego County Bicycle Coalition

California S Electric Motorcycle Rebates Webbikeworld

Synergist Wealth Advisors Llc The Usa Advisor Investment Firms Wealth

1975 Harley Davidson Special Construction Harley Davidson Touring Harley Davidson Harley Davidson Museum

Tesla Tsla Becomes World S Most Valuable Automaker Hits 1 000 Per Share Tesla Model Tesla Tesla Model S